Wonder Women Video Career Mentoring

Episode 1 - Shannon Spotswood | President | RFG Advisory

This is Part 1 of our Wonder Women Video Series. Look for more episodes throughout the year!

Before she was President at RFG Advisory, Shannon was a portfolio manager of a hedge fund (that means she managed the investment strategy for a BIG fund that lots of people invested in, with the goal of making money for all the people that invested in it!). She’s been passionate about the world of finance ever since she got a subscription to the Wall Street Journal (that’s THE media source for the financial world) for her 14th birthday! And, she was most recently named a 2020 Woman to Watch by Investment News (this is a big deal, only about 20 women are given this prestigious honor annually). Watch the video below to hear Shannon’s story and tips for success!

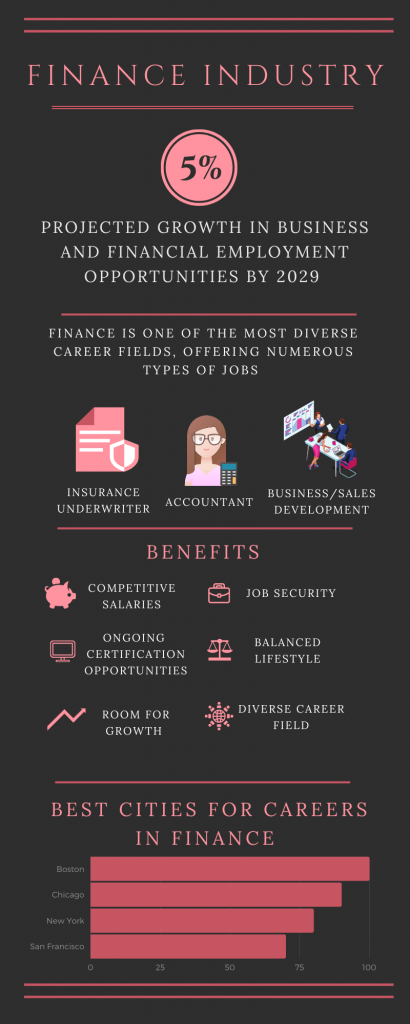

Here’s some more info on careers in finance!

Those entering the workforce armed with a degree in finance face a tough choice. Do they head to Wall Street and the lucrative, although risky, world of high finance? Or, do they head away from the path of the investment banker and develop the tools to become a future giant of corporate finance?

Types of Careers

Financial Planner – A qualified investment professional who helps individuals and corporations meet their long-term financial objectives

Portfolio Manager – A person or group of people responsible for investing a mutual, exchange traded or closed-end fund’s assets, implementing its investment strategy, and managing day-to-day portfolio trading

Accountant – A professional who performs accounting functions such as account analysis, auditing, or financial statement analysis.

Business Development/Sales – As the ideas, initiatives, and activities aimed towards making a business better

Insurance Underwriter – Evaluate the risks involved in insuring people and assets and establish pricing for a risk.

Compliance Officer – An employee of a company that ensures the firm is in compliance with its outside regulatory and legal requirements as well as internal policies and bylaws

If you like the industry of finance but aren’t all that into numbers or analytics, there are lots of other ways to get involved, like jobs in Marketing, Social Media, or PR for Financial Firms. Think outside the box!

Education

If you do plan to pursue a traditional field in the financial industry, an undergraduate (Bachelor’s) degree in one of the following fields will be a good start and can be completed in 4 years or less.

-

- Accounting

- Business

- Economics

- Finance

- Financial Planning

- Pre-Law

- Mathematics

Depending on what specialty you go into, you may want to get an advanced degree or certificate, but it’s not an absolute necessity. Here are some examples:

Advanced Degree

- Master of Science in Finance (MSF)

- Masters in Finance vs Economics vs Master of Business Administration

- Master of Business Administration (MBA)

- 10 Companies that will Pay for Your MBA

- These 3 Investment Banks will Pay for Your MBA

The Best Online Master’s Programs of 2020

- Best Overall: University of Southern California

- Best Value: Western Governors University

- Best Online MBA: Indiana University

- Best for Master’s of Education: University of Illinois

- Best for Computer Science: North Carolina State

Certifications

Financial Certifications with the Best ROI

- Certified Financial Planner (CFP)

- Personal Financial Specialist (PFS)

- Chartered Financial Consultant (ChFC)

- Chartered Financial Analyst (CFA)

Career Prospectus (How much does it pay, what is the work-life balance, etc?)

Depending on the specialty you select within the field of finance, the salary will vary, but here are some average 2019 starting salaries for jobs in the U.S:

- Financial Planner | $67,620

- Accountant | $44,480

- Financial Analyst/Portfolio Manager | $52,540

Any of the jobs above can be a great choice for work-life balance and working moms as most can be done at least partially remotely and with flexible hours.

Things to Think About

Do you like working with people? If so, you might like financial planning where you get to help people focus on their goals and dreams. If you prefer number crunching and behind the scenes, you might want to be an auditor or an accountant.

If you like to be in the heat of the moment, where the action is, you might like working as a portfolio manager or a position that is more closely tied to the daily ups and downs of the stock market.

It’s always a good idea to learn about the jobs you’re interested in pursuing by watching videos, sending an email to one of our mentors, or even calling. People are usually willing to share their knowledge and it’s a great way to learn about careers before choosing a path or college major!

How to get Experience

-

Internships – Internships can be paid or unpaid, but they give you a chance to explore a career before fully committing, and can also be a great way to make connections. Search for internships on https://www.internships.com

-

Volunteer – Volunteering almost always means unpaid, but this is also a great way to learn about your industry and make connections. Often times, who you know makes a big difference when starting your career search.

We hope these tips will get you on your way to career success! Remember to check out the other episodes in our Video Mentoring series too! There’s more to come!